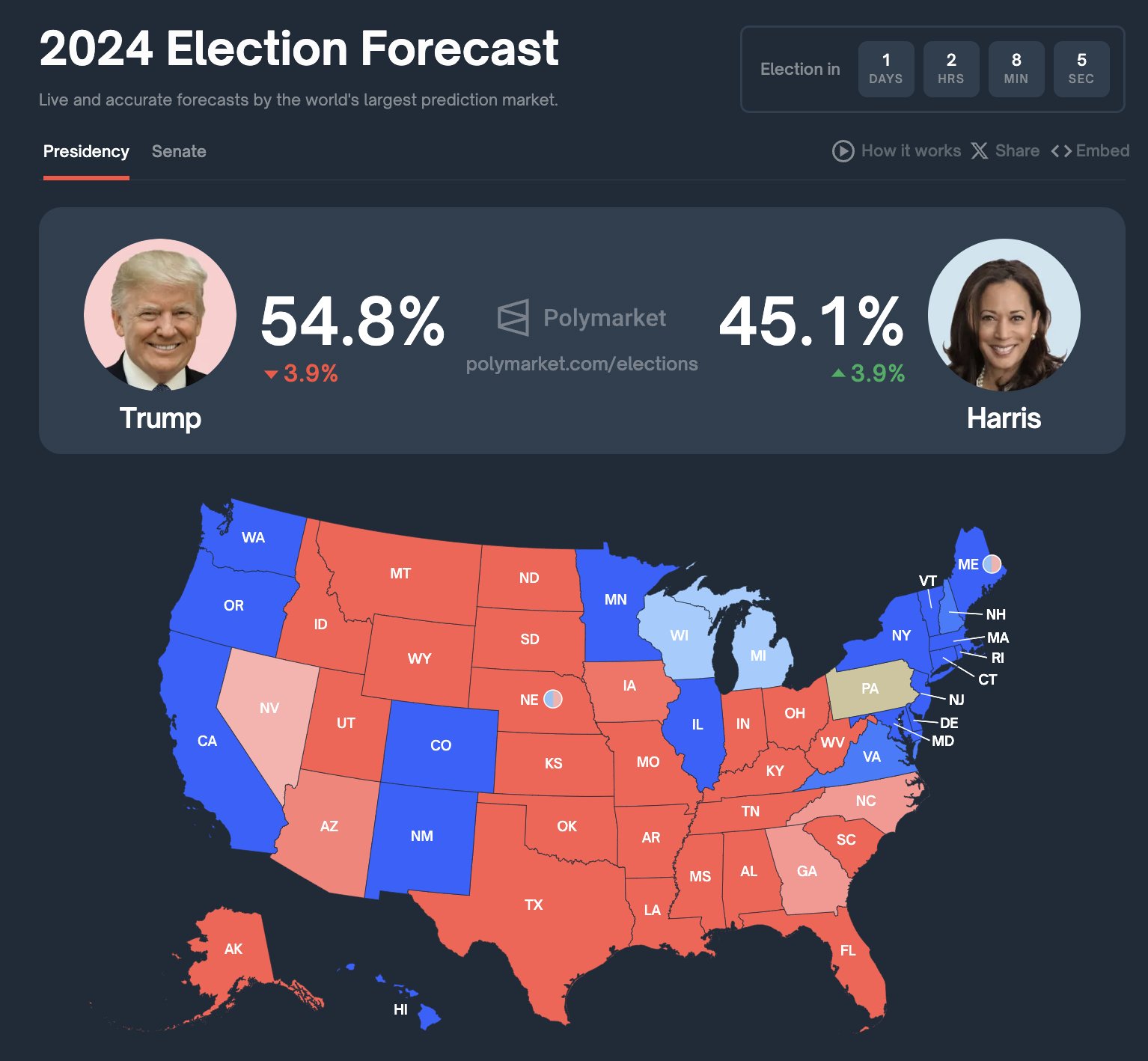

Polymarket, with over $2.7 billion wagered on the Trump-Harris matchup, has also emerged as a major player in election forecasting. Endorsed by Elon Musk, who claimed it’s “more accurate than polls, as actual money is on the line,” the platform has gained credibility through its track record of political predictions, including Biden’s withdrawal and Tim Walz’s selection as Harris’s running mate.

BY PC Bureau

As the 2024 U.S. presidential race heats up, betting markets—like opinion polls—show a divided forecast. Donald Trump has consistently held an edge in most betting markets, but recent odds reveal growing bets on a potential Kamala Harris victory.

Betting platforms like BetOnline, Betfair, and Bovada have largely favored Trump, with an average probability of 54.3% compared to Harris’s 44.4%. This trend suggests many bettors see Trump as having a steady advantage, but the scales may be shifting.

Notably, Interactive Brokers’ founder and chairman Thomas Peterffy described the recent momentum for Harris as a “ferocious comeback,” signaling an unexpected shift in the race. According to Peterffy, some polls indicate Harris is now leading, a dramatic development that’s stirring up interest in the final hours.

Forecast Trader, a prominent U.S. betting market closely watched by Wall Street, also reflects this twist. While Polymarket, a cryptocurrency-based betting platform, continues to forecast a Trump win, Forecast Trader has Harris holding a lead in the final stretch. The divide across platforms highlights the unpredictable nature of the race as bettors rally around both candidates.

Also Read: Hippo for Trump, Litchman for Harris

Polymarket, with over $2.7 billion wagered on the Trump-Harris matchup, has also emerged as a major player in election forecasting. Endorsed by Elon Musk, who claimed it’s “more accurate than polls, as actual money is on the line,” the platform has gained credibility through its track record of political predictions, including Biden’s withdrawal and Tim Walz’s selection as Harris’s running mate. Yet, Polymarket’s reliability faces scrutiny. Blockchain security firms Chaos Labs and Inca Digital have questioned the authenticity of its reported $2.7 billion transaction volume, suggesting that the actual figure may be closer to $1.75 billion. They speculate the inflation could be due to “wash trading,” where repeated asset trading artificially increases volume, which raises doubts about whether Polymarket’s odds reflect genuine sentiment or strategic manipulation.

Despite these controversies, betting platforms have become influential in shaping election narratives. Thomas Peterffy of Interactive Brokers noted that prediction markets, regulated by the Commodity Futures Trading Commission (CFTC), are closely monitored to prevent election interference, with serious consequences for any attempted manipulation. He remains confident that while these markets do provide insights, they operate within legal boundaries, making any tampering unlikely.

With Election Day just hours away, both candidates’ supporters are rallying to cast their final predictions, and betting markets continue to reflect the country’s polarized views on the race’s outcome.