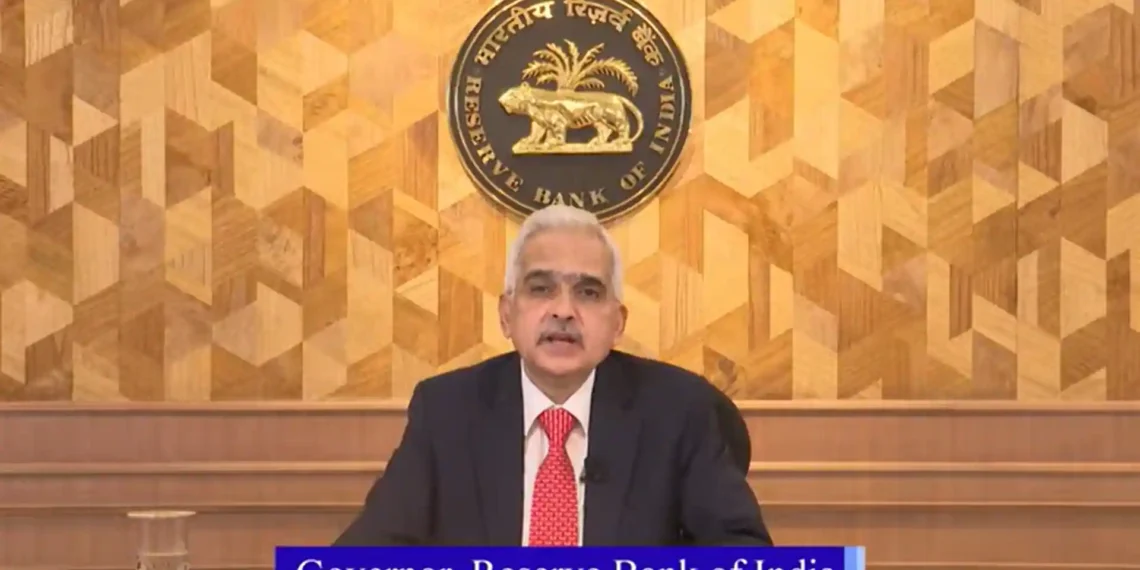

Governor Shaktikanta Das emphasizes the need for price stability, with inflationary risks overshadowing growth concerns. The central bank stays vigilant as it revises GDP growth projections for FY25.

BY PC Bureau

The Reserve Bank of India (RBI)) has decided to maintain the repo rate at 6.5% and downgraded the GDP growth forecast from 7.2% to 6.6%. The decision, taken with a 4:2 majority, reflects the central bank’s cautious stance amid persistent inflationary pressures and global uncertainties.

RBI Governor Shaktikanta Das emphasized that high inflation continues to pose a substantial challenge, eroding disposable incomes and dampening private consumption, which adversely impacts econD

Das said that that the Monetary Policy Committee (MPC) acknowledged the GDP growth data for the second quarter of FY2025 and revised the full-year real GDP growth forecast significantly downward, from 7.2% to 6.6%.

“High inflation reduces disposable income and affects private consumption, negatively influencing real GDP growth. Additionally, adverse weather events, geopolitical uncertainties, and financial market volatility pose upside risks to inflation. The MPC remains committed to ensuring durable price stability as a foundation for sustained growth,” Das said.

The six-member MPC, chaired by Governor Das, began its bi-monthly deliberations on Wednesday, marking his final policy meeting as chairperson before his tenure concludes on December 10.

Balancing Inflation and Growth

Das highlighted that the RBI’s anti-inflationary measures have been instrumental in achieving significant progress toward disinflation, despite recent upticks. “Headline inflation is expected to realign with the target as food price shocks ease. However, prudence demands a status quo in monetary policy to monitor evolving data and preserve the gains made so far,” he added.

The central bank also noted that agriculture and industrial activity are expected to provide a positive impetus to growth. A healthy Kharif crop, better reservoir levels, and improved rabi sowing have bolstered agricultural growth, while industrial sectors such as mining, electricity, cement, and steel are recovering from monsoon-related disruptions.

Sectoral Outlook

- Industrial Recovery: Industrial activity is normalizing, supported by government capital expenditure and improved conditions post-monsoon. Mining and electricity sectors are rebounding after being key drags on Q2 GDP.

- Manufacturing and Services: The Purchasing Managers Index (PMI) for manufacturing stood at a robust 56.5 in November, while services PMI remained strong at 58.4, indicating sustained expansion.

- External Trade: Merchandise exports grew by 17.2% in October, while services exports showed a healthy increase of 22.3%.

- Demand Trends: Rural demand is on an upward trend, whereas urban demand is moderating due to a high base. Government consumption and investment activity are showing improvement.

Das reiterated that the evolving economic landscape requires vigilance. “We must remain sensitive to the complexities and ramifications of the current situation. Maintaining the status quo in monetary policy is both prudent and essential at this juncture,” he concluded.

The RBI’s focus remains on striking a delicate balance between curbing inflation and supporting economic recovery, ensuring a sustainable path forward for the Indian economy.