Krystal Integrated Services Limited, a leading player in the facilities management services sector, is gearing up to launch its initial public offering (IPO) on Thursday, March 14, 2024. This move marks a significant milestone for the company as it seeks to tap into the capital markets to fuel its growth trajectory.

Details of Krystal Integrated Services IPO

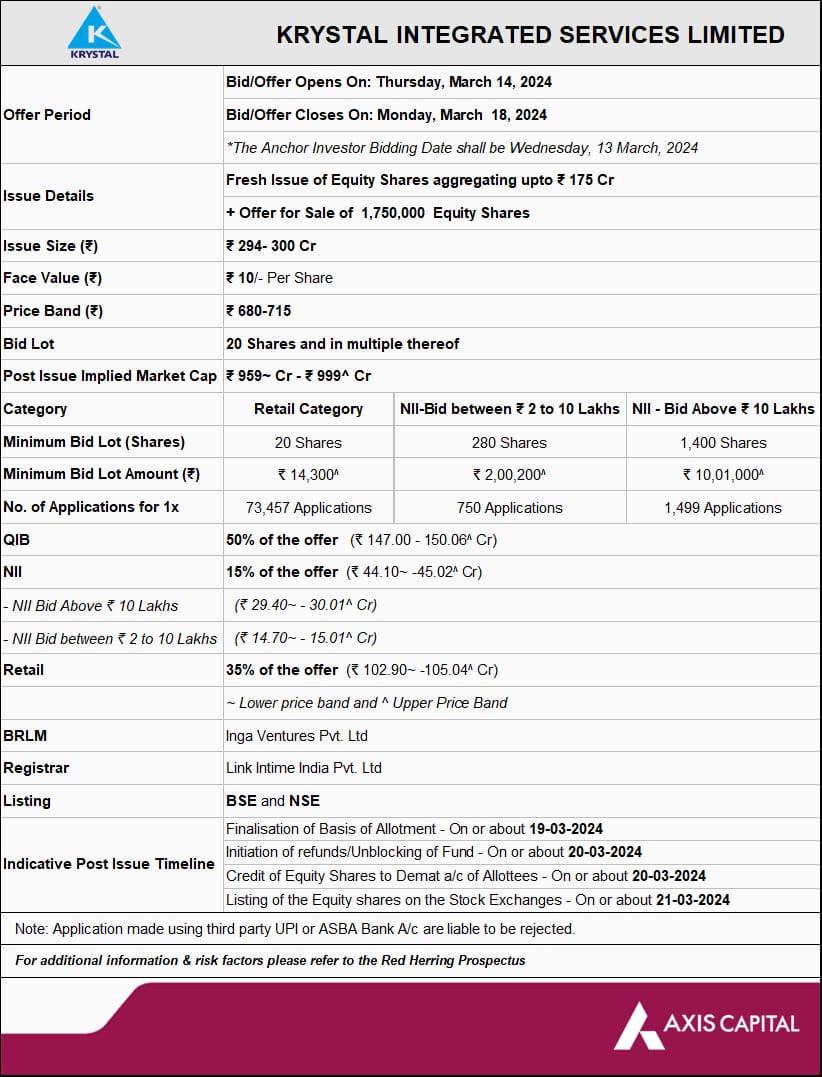

The IPO is structured to raise funds through a combination of fresh issue of shares and an offer to sell existing shares. Potential investors interested in the Krystal Integrated Services IPO can subscribe to the public issue until March 18, 2024. The allotment process is expected to be finalized by March 19, 2024, with the company aiming to list its shares on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) by March 21, 2024.

Read More – Tata Sons’ IPO Delayed; Tata Chemicals Stock Crashes

Valuation of Krystal Integrated Services IPO

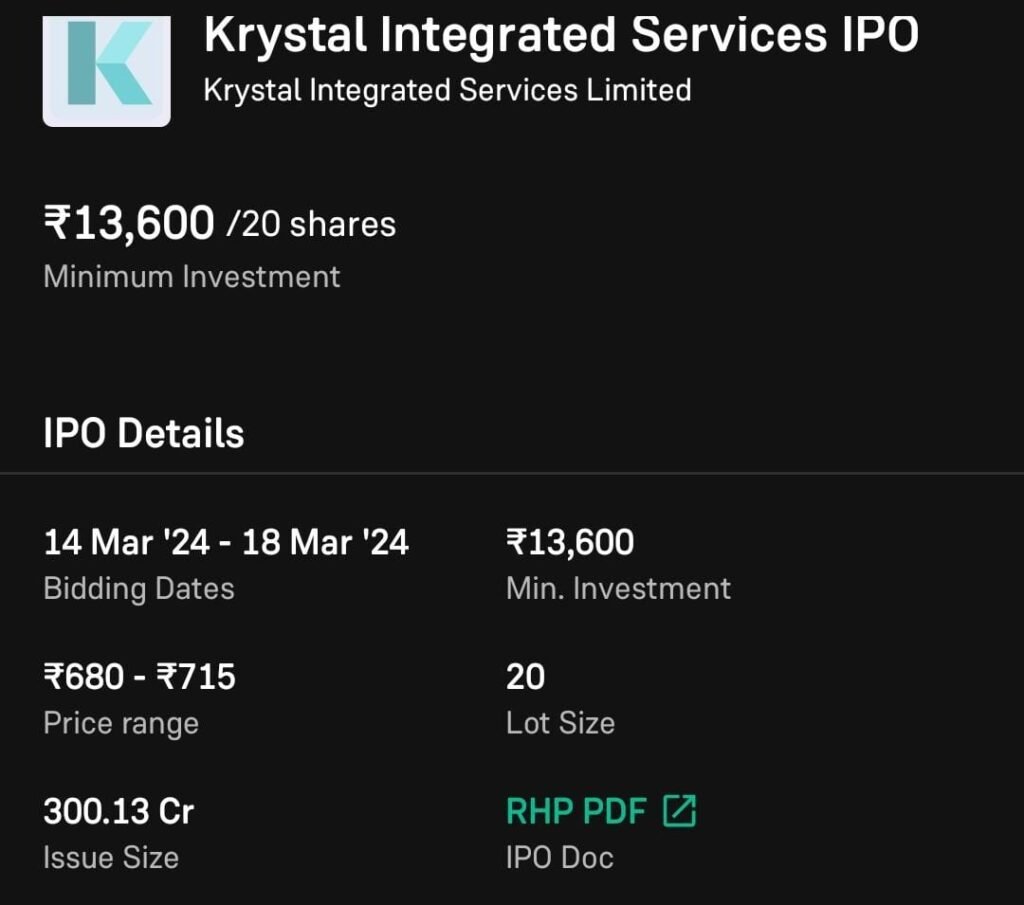

The valuation of the Krystal Integrated Services IPO is pegged at Rs 300.13 crore, comprising a fresh issue of 24 lakh shares worth Rs 175.00 crore and an offer for sale of 18 lakh shares totaling Rs 125.13 crore.

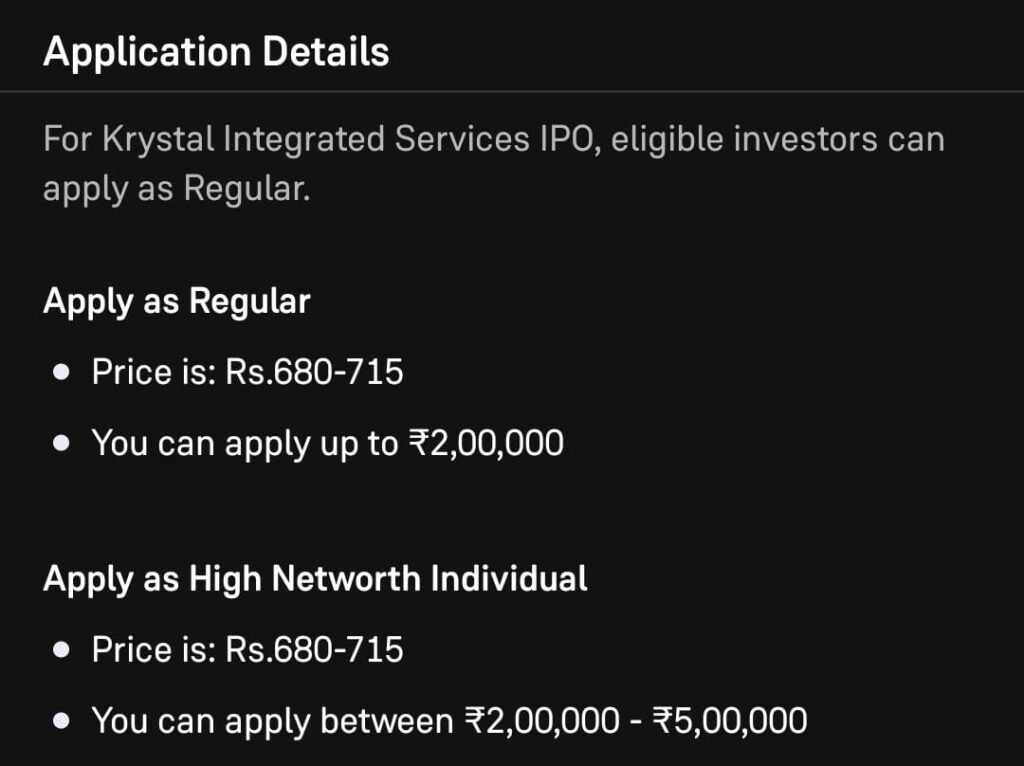

The IPO price band has been set between Rs 680 and Rs 715 per share, with a minimum lot size of 20 shares. Retail investors must invest a minimum of Rs 14,300, while non-institutional investors (NII) need to invest in 14 lots (280 shares), amounting to Rs 200,200. Qualified institutional buyers (QIB) must invest in 70 lots (1,400 shares), totaling Rs 1,001,000.

Also Read – 5 Tata Group IPOs Set To Be Launched in 2024

Who manages Krystal Integrated Services IPO?

Inga Ventures Pvt Ltd is spearheading the book-building process for the Krystal Integrated Services IPO, with Link Intime India Private Ltd appointed as the registrar to the issue.

The proceeds from the IPO will be utilized for various purposes, including repayment of borrowings, funding working capital requirements, investment in new machinery, and general corporate purposes. This strategic allocation of funds underscores the company’s commitment to driving sustainable growth and enhancing shareholder value.

Read More – This IPO Allotment Gave Immense Wealth To Investors: Know Strategy

Should you Buy Krystal Integrated Services IPO?

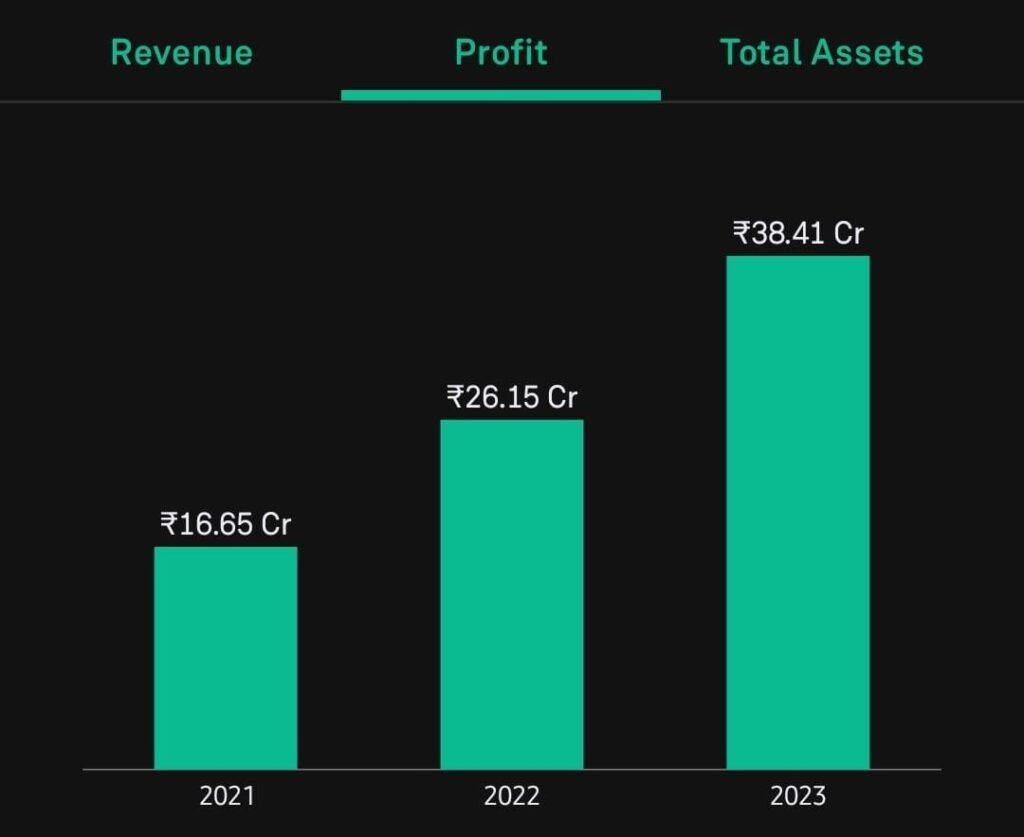

Several factors merit consideration for investors evaluating whether to participate in the Krystal Integrated Services IPO. The facilities management services sector, in which Krystal operates, has witnessed steady growth driven by increasing demand for integrated solutions across industries. Krystal’s established presence in this sector and its track record of delivering high-quality services position it favorably to capitalize on emerging opportunities.

Additionally, the IPO’s pricing and valuation metrics should be carefully assessed to determine its attractiveness from an investment perspective. While the pricing band offers a range for investors, thorough due diligence is essential to ascertain the IPO’s intrinsic value and growth potential.

In conclusion, the Krystal Integrated Services IPO presents an opportunity for investors to participate in the growth story of a reputable player in the facilities management services sector. However, investors should conduct comprehensive research and analysis to make an informed decision aligned with their investment objectives and risk appetite.

Disclaimer: The views and tips expressed by investment experts on Moneycontrol.com are their own, not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.