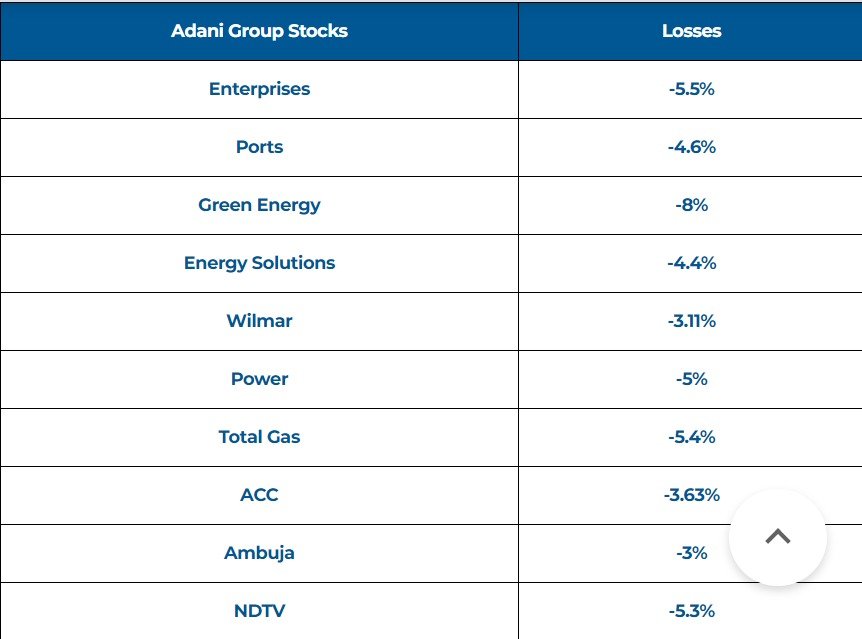

As the trading day unfolds on Wednesday, March 13, the turmoil in the market has hit the Adani Group particularly hard, with a cascade of losses impacting all ten of its stocks. The conglomerate’s entities are grappling with huge losses from Adani Ports to Adani Wilmar and significant players like ACC and Ambuja Cements.

The severity of this downturn is evidenced by Adani Ports and Adani Enterprises’ positions among the top five losers on the Nifty 50 index, with the latter experiencing a notable decline of 5.5%.

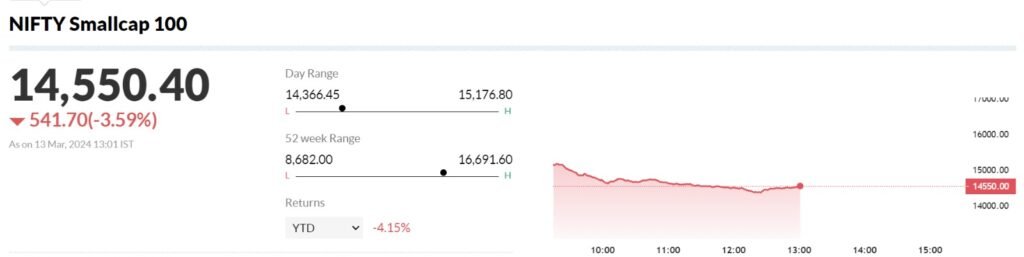

Nifty Small Cap and Midcap Stocks Crash

The broader market indices, including the Midcap Index and the Nifty Small Cap Index, are bearing the brunt of the downturn, with the former recording its most substantial fall of 2024. As the day unfolds, all ten Adani Group stocks, spanning from Ports, Enterprises, to Total Gas and Adani Wilmar, along with Cement majors ACC and Ambuja, are grappling with losses ranging between 5% to 10%.

Also Read – Krystal Integrated Services IPO Opening tomorrow, Buy or Ignore? Find Out

Among the Nifty 50 constituents, Adani Ports and Adani Enterprises have emerged as prominent casualties, securing positions among the top five losers. Adani Enterprises, the flagship entity of the conglomerate, has experienced a decline of 5.5%, while shares of Adani Ports have plummeted by over 4.5%.

Adani Ports, Adani Enterprise Bleed Most

The downward spiral extends beyond these key players, with Adani Total Gas, Adani Green Energy, Adani Wilmar, ACC, and Ambuja Cements all witnessing significant losses in mid-week trading. The cumulative market capitalization loss of Rs 90,000 crore incurred by all Adani Group stocks today is staggering, accounting for 5.7% of the group’s total market cap of nearly Rs 15.85 lakh crore as of the previous trading day.

Read More – PM Modi Lays Foundation Stone for ₹1.25 Lakh Crore Semiconductor Projects in Gujarat, Assam

The trend of decline is further underscored by the prolonged downturn in Adani Enterprises, marking its seventh consecutive day of losses. On the other hand, Adani Ports has observed a decline of nearly 8% over the past two trading sessions, indicative of the sustained downward trajectory.

Particularly noteworthy is the sharp decline witnessed by shares of Adani Green Energy, marking the most significant single-day drop observed in 2024 thus far. Adding to the woes, several other Adani Group stocks grapple with losses for the second consecutive day, indicating a persistent downward trend.

The decline in Adani Group stocks is in sync with the broader market sentiment, characterized by substantial losses in the Nifty Midcap and Nifty Smallcap indices, down over 3%. This downturn marks the third consecutive day of losses for these broader market indices, signaling a broader market correction.

In summary, today’s trading session has been marked by substantial losses across Adani Group stocks, reflecting broader market corrections and investor sentiment amid prevailing market conditions.