Tata Group‘s stock rally has hit a significant roadblock as Tata Sons, the conglomerate’s holding company, faces regulatory hurdles that could delay its anticipated IPO. Amid speculation surrounding the IPO, Tata Group’s recent surge in stock prices, particularly Tata Chemicals, may be impacted as Tata Sons navigates challenges to avoid listing under RBI rules.

The multi-billion-dollar rally witnessed this week, sparked by a bullish scenario surrounding Tata Sons, might soon fade away as the conglomerate navigates regulatory hurdles to circumvent the IPO.

Also Read – 5 Tata Group IPOs Set To Be Launched in 2024

Tata Chemicals Stock Could Crash?

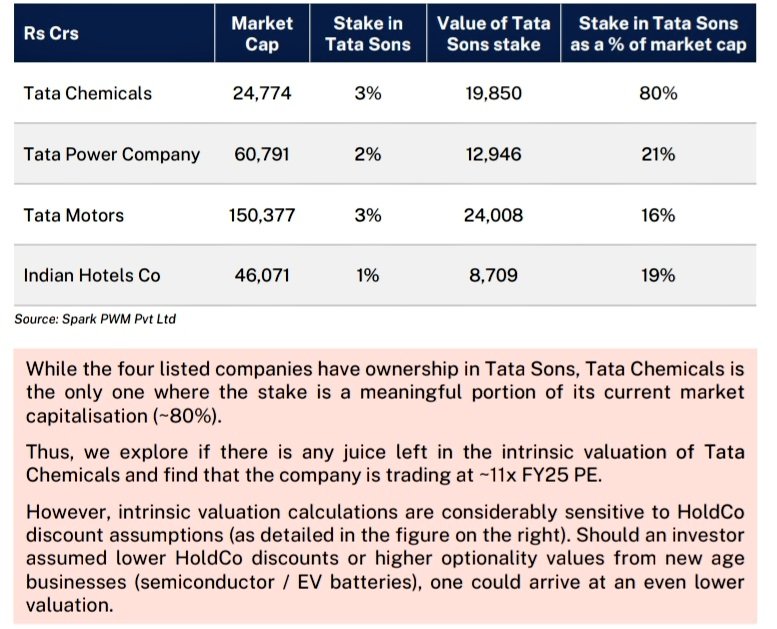

The rally, which saw significant gains in Tata group stocks, particularly Tata Chemicals, was fueled by the prospect of Tata Sons going public. Tata Chemicals has seen a rally of almost 36% in 4 trading days on speculations surrounding Tata Sons’ IPO. However, investor sentiment has been tempered after the recent events, and Tata Sons is now exploring alternatives to avoid listing.

Tata Sons, the conglomerate’s holding company, faces a regulatory requirement to get listed by September 2025, as it has been classified as an upper-layer Non-Banking Financial Company (NBFC). Tata Sons is considering restructuring its balance sheet to evade this listing mandate under RBI rules.

Also Read – Tata Group’s Valuation Surpasses Pakistan’s $341 Billion GDP

When is the Tata Sons IPO coming?

To get the IPO listed soon, one potential strategy being explored is the reorganization of debt, either through the repayment of borrowings or the transfer of holdings in Tata Capital to another entity. By doing so, Tata Sons aims to deregister as a core investment company (CIC) and upper-layer NBFC, effectively sidestepping the listing requirement.

Despite seeking an exemption from the listing rule from the Reserve Bank of India (RBI), Tata Sons’ plea was rejected. As a result, the conglomerate is now consulting legal and financial experts to devise a solution to navigate the regulatory landscape.

Also Read – Tata Announces Demerger into These Listed Companies

While investors initially rallied behind Tata group stocks, particularly Tata Chemicals, in anticipation of a potential IPO, market experts caution against making investment decisions solely based on speculation. The recent surge in stock prices, fueled by the IPO frenzy, has prompted analysts to recall similar episodes in the past, urging caution and skepticism.

As Tata Group grapples with regulatory challenges and works towards averting the Tata Sons IPO, the future trajectory of stock prices remains uncertain. While the fundamental growth story of Tata Group continues to underpin investor interest, the IPO speculation and subsequent regulatory hurdles add a layer of complexity to the investment landscape.