Top management of Tata Consumer Products Ltd. (TCPL) stated during the company’s post-earnings call on Wednesday that the company anticipates India tea volumes to grow between 2% and 4% in the short term and returning to mid-single digit growth in the medium to long term.

TCPL Reports Flat Tea Sales and 9% Increase in Total Operating Revenue for Q4 FY24

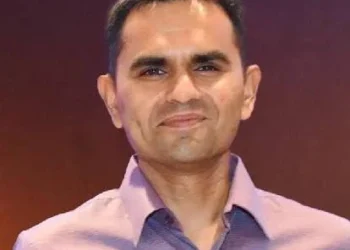

“We saw volumes coming to two-to three percent growth, so this quarter was a bit soft (for tea) compared to what we were seeing as a trend,” TCPL managing director and CEO Sunil D’Souza said on the company’s post-earnings call on Wednesday.

The producer of packaged pulses and salt made its earnings announcement for the March quarter on Tuesday. In the quarter that concluded on March 31, 2024, the business revealed flat tea sales compared to the previous year. Annually, tea volumes increased by 2%. The company stated that the market share of tea has remained consistent from quarter to quarter.

The quarter’s total operating revenue increased by 9% to ₹3,927 crore. With revenues of ₹15,206 crore for the entire fiscal year 2024, TCPL reported a 10% increase in sales.

Also Read: Analyzing the Factors Behind Jio Financial Services’ 73% Stock Rally in 6 months

TCPL Forecasts Short-Term Volume Increase and Projects Mid-Single Digit Growth for Tea Sales

“In the short term, we do anticipate at least a two to four percent increase in volume, but in the medium to long term, we do anticipate tea to return to a mid-single digit volume growth,” D’Souza stated. The India beverages portfolio of the company includes coffee in addition to tea. A major participant in the branded tea industry is TCPL. The company sells packaged tea in India under the Tetley, Agni, Tata Tea, and Kanan Devan brands, among others.

In India, one out of every three households drinks Tata Tea. In India, Tata Tea is the second-biggest tea brand.

The packaged tea category in fiscal 2022 was impacted by inflationary headwinds in tea prices. Customers began to downtrade TCPL as a result. But thanks to proactive measures, tea prices have started to decline over the past few quarters and volumes have started to increase.

According to the company’s Q4 earnings presentation, average tea prices in North India were 8% lower in March than they were a year earlier, while average tea prices in South India were 15% lower.

Also Read: Vi Faces Share Price Volatility Ahead of FPO Listing; Shares Drop 9%

TCPL’s Positive Volume Growth and Focus on Future Volumes Amidst Inflationary Pressures

In a research note on the company published in March, analysts at Nuvama Institutional Equities stated, “TCPL has now turned in four consecutive quarters of positive volume growth.”

Companies have suffered over the last two years due to rising food inflation and rising commodity prices. Mass-market product growth was hindered as a result, as businesses had to increase prices or decrease grammage in order to maintain profit margins. Companies anticipate that they will now once again concentrate on volumes in the future.

Coffee, on the other hand, maintained its impressive performance during the quarter, growing its revenue by 45%.