The semiconductor behemoth Nvidia, which created ChatGPT and other AI tools, is closing quickly on Apple’s position as the second-most valuable company in the world. According to a report, Nvidia’s market valuation has risen from $1 trillion to over $2 trillion in just nine months, surpassing Amazon.com, Google parent Alphabet, and Saudi Aramco in the process. This is a remarkable rally driven by advancements in artificial intelligence.

“Nvidia’s Meteoric Rise: Dominance in AI Chips Drives Wall Street Surge”

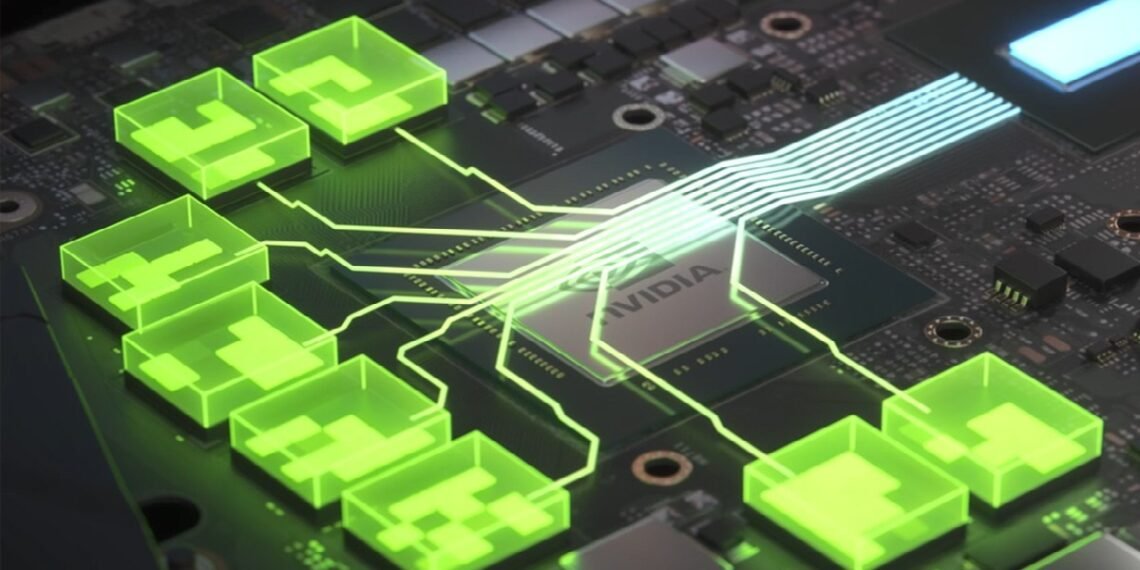

With a current valuation of about USD 2.38 trillion, Nvidia is currently worth about USD 230 billion less than Apple and roughly USD 645 billion less than Microsoft. With 80 percent of the market for high-end AI chips under its control, the company’s unrelenting rise has driven Wall Street to all-time highs this year, with Nvidia holding a five percent weight in the benchmark S&P 500 index.

This year, Nvidia has increased by an astounding 95%, and Meta Platforms has increased by 46.6%, outpacing the other members of the “Magnificent 7,” demonstrating investors’ insatiable appetite for assets related to artificial intelligence.

“Nvidia’s Spectacular Rise Faces Peak Speculation: Insights from Investment Experts”

“Nvidia’s rally reflects the incredibly strong fundamentals underlying its current business model,” observes Cherry Lane Investments partner Richard Meckler. He cites widespread speculative interest from long option buyers amid the stock’s upward trajectory throughout 2024.

Also Read: Congress taken aback as prominent Madhya Pradesh leaders join the BJP

In January, Apple lost its ranking as the most valuable U.S. company to Microsoft due to difficulties with iPhone sales, and in recent weeks, Nvidia overtook Tesla as the most traded stock on Wall Street based on value.

It’s possible that Nvidia’s stock is nearing its peak despite its strong performance. The median target price set by analysts for the next twelve months indicates a valuation of $850 per share, which is less than the closing price of $926. The portfolio manager at Aptus Capital Advisors, David Wagner, highlights that Nvidia is “the cheapest of the ‘AI narrative’ stocks” due to its significantly lower forward price-to-earnings ratio.