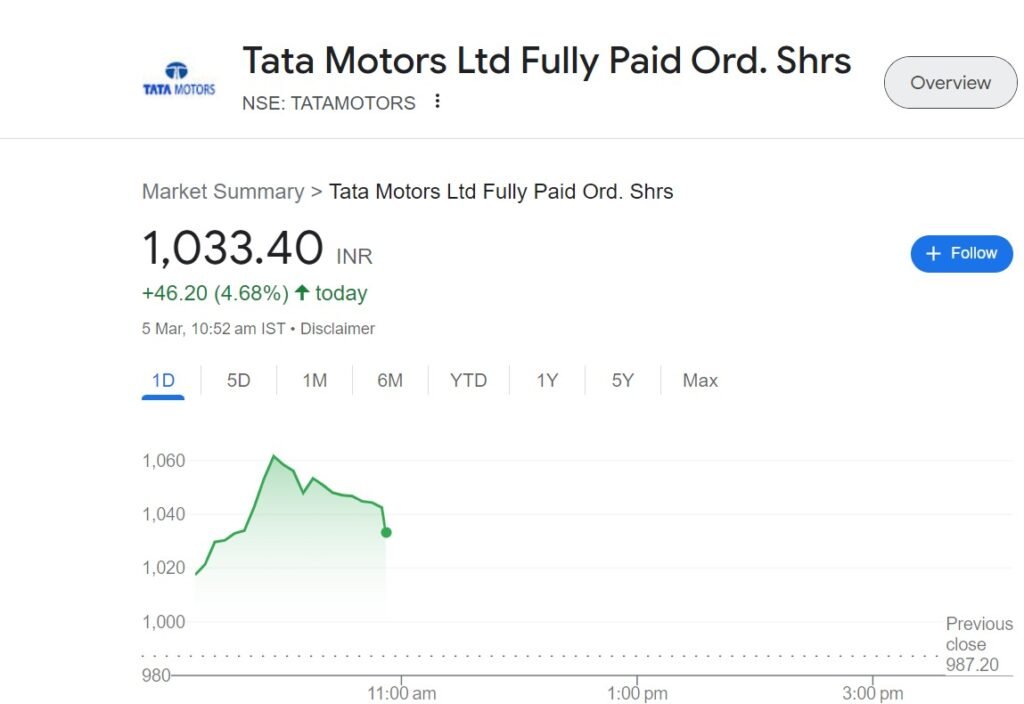

Tata Motors, the global automobile manufacturer, shares experienced a notable surge of 8% during today’s early trade. This surge propelled the stock past the significant milestone of ₹1000 to reach ₹1065.60 per share. The remarkable uptick in share value was spurred by the company’s board of directors unveiling a strategic demerger plan.

The Tata Motors’ demerger plan, approved on Monday, involves the division of Tata Motors into two distinct listed entities. The first entity will focus on the Commercial Vehicles (CV) business and its associated investments. In contrast, the second entity will be dedicated to the Passenger Vehicles (PV) segment, encompassing PV, Electric Vehicles (EV), Jaguar Land Rover (JLR), and their related investments.

Also Read – Tata Motors Announces Demerger into Two Listed Companies

Tata Motors – Analyst Insights and Stellar Rally

Commenting on the implications of Tata Motors’ demerger plan, Mr. Ashwin Patil, Senior Research Analyst at LKP Securities, emphasized the potential benefits of splitting the business value between CVs and PVs. This strategic move, long anticipated by industry analysts, is expected to enhance focus and flexibility within each segment, enabling Tata Motors to capitalize on growth opportunities more effectively.

Furthermore, Tata Motors has experienced a stellar rally in its stock price over the past year. Buoyed by notable improvements in its Jaguar and Land Rover business and the commercial vehicle segment, the stock has witnessed a consistent upward trajectory. After concluding CY23 with a multi-bagger return of 101%, Tata Motors remains the only Nifty 50 stock to achieve this feat in the year.

Tata Motors to demerge its businesses into two separate listed companies.

A) Commercial Vehicles business in one entity

B) Passenger Vehicles businesses including PV, EV, JLR in second entity pic.twitter.com/96MHbP37x0

— AIM Investments (@AimInvestments) March 5, 2024

The positive momentum has continued into CY24, with the stock already delivering an impressive return of nearly 36%. Notably, Tata Motors’ stock has closed in the green for 9 out of the last 11 months, underscoring investor confidence and market optimism surrounding the company’s performance and strategic initiatives.

Also Read – Check out Top 3 Upcoming Electric Cars in India

Tata Motors – Future Outlook and Market Dynamics

The demerger plan is expected to position Tata Motors for sustained growth and competitiveness in the automotive industry. By creating two distinct listed entities, the company aims to leverage each segment’s unique strengths and market dynamics, thereby enhancing operational efficiency and value creation for shareholders.

Furthermore, the demerger plan underscores Tata Motors’ commitment to driving innovation and meeting evolving consumer preferences in both the commercial and passenger vehicle segments. As the automotive industry undergoes rapid transformations driven by technological advancements and changing consumer behaviors, Tata Motors’ strategic initiatives are poised to strengthen its position as a leading player in the global automotive market.

In conclusion, Tata Motors’ shares surged 8% following the announcement of its demerger plan, signaling investor enthusiasm and confidence in the company’s strategic direction. With a focus on enhancing operational efficiency and unlocking shareholder value, Tata Motors is poised for continued growth and success in the dynamic automotive industry.