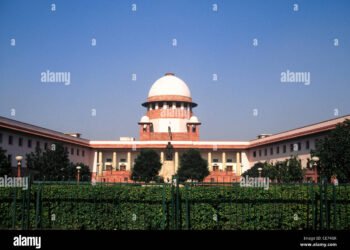

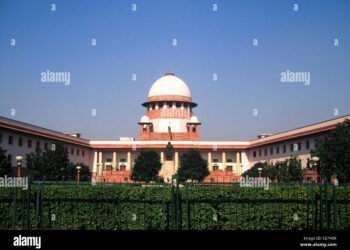

In a momentous verdict on Thursday, the Supreme Court revoked its previous verdict and upheld states’ powers to impose royalties on mining and mineral-use operations. In an 8:1 decision, the bench led by Chief Justice of India DY Chandrachud decided that ‘royalty’ is not synonymous with ‘tax’ and that governments have the competence and authority to levy royalty. Justice BV Nagarathna delivered the dissenting verdict.

‘Observation in India Cements case in incorrect’: Supreme Court

“Royalty is not the same as tax…We conclude that the observation in the India Cements case indicating that royalty is tax is incorrect. Payments made to the government cannot be considered a tax just because a statute allows for its recovery in arrears,” the Chief Justice stated.

“We hold that state legislature is competent while designing a levy under entry 49 of list 2 to tax lands which comprises of mines and quarries,” he added.

Also read: Supreme Court pauses UP’s Kanwar Yatra nameplate order

Majority of judges held that states retain the authority to impose cesses

The majority of the judges on the bench ruled that states retain the authority to impose cesses on mining and related businesses.

“The legislative ability to tax mining rights belongs with the state legislature, and the Parliament does not have the legislative competence to tax mineral rights…because it is a general entry, and Parliament cannot exercise its residuary jurisdiction on this topic… State legislature has the legislative authority to tax mineral bearing property under Article 246 in conjunction with Entry 49 of List 2”, the majority ruled.

Justice Nagarathna disagreed on both aspects.

“I believe royalty is in the form of a tax. States have no legislative authority to levy a tax or fee on mineral rights…I believe the India Cements ruling was correct,” she remarked.