Spanish PM Pedro Sanchez purchases Ganesh idol on 3-day India visit; uses India’s digital payment system

Prime Minister of Spain, Pedro Sanchez, used India’s digital payment system, UPI, to buy an idol of Lord Ganesh at a store in Mumbai on Tuesday. Sanchez, who is visiting India for the first time, received guidance from an official about the advantages and uses of UPI before making the payment.

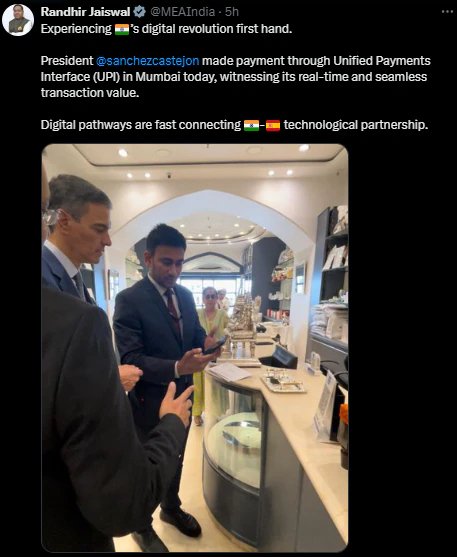

“Experiencing India’s digital revolution first hand. President @sanchezcastejon made a payment through Unified Payments Interface (UPI) in Mumbai today, witnessing its real-time and seamless transaction value. Digital pathways are fast connecting India-Spain technological partnership,” MEA spokesperson Randhir Jaiswal tweeted.

Spanish PM and his wife got involved in Diwali celebrations by lighting diyas and setting off pencil crackers. They also indulged in tasty Indian treats, such as ladoos.

Also read: 32 Air India flights receive fresh bomb threats amid security concern

Sanchez is on a three-day India visit. On Wednesday, he will attend an event in Mumbai before heading to Spain. On Monday, he and his spouse Begona Gomez took part in Diwali festivities in India’s economic hub.

Numerous global leaders have attempted using UPI while visiting India in the past. Earlier this year, Prime Minister Narendra Modi and French President Emmanuel Macron, who was visiting India, had a cup of tea before using UPI for the payment, leaving the French leader amazed.

Prime Minister Narendra Modi and Sanchez unveiled the Tata Advanced System Limited-Airbus facility for producing C-295 military aircraft in India on Monday.

Also read: Modi, Spanish PM launch Tata-Airbus aircraft plant in Vadodara

Prime Minister Narendra Modi and Spanish Prime Minister Pedro Sanchez had jointly inaugurated an aircraft manufacturing facility in Gujarat’s Vadodara, on Monday, which will collaborate with Spain’s Airbus to develop fighter aircraft.

What is UPI

The National Payments Corporation of India (NPCI) introduced UPI in 2016 and it is overseen by the RBI. A payment system based on smartphones, UPI, enables users to send money between bank accounts using one identifier like a mobile number, QR code, or Virtual Payment Address (VPA).

It eliminates the need of inputting bank information or sensitive data for every transaction and employs a two-step verification method, usually with a UPI pin, for secure transactions.