The Reserve Bank of India (RBI) has taken steps to address customer concerns amid the Paytm Payments Bank (PPB) crisis. On Friday, the RBI issued a comprehensive list of frequently asked questions (FAQs) to clarify various aspects of PPB’s operations and customer accounts.

Here’s a detailed breakdown of the RBI FAQs regarding Paytm Payments Bank:

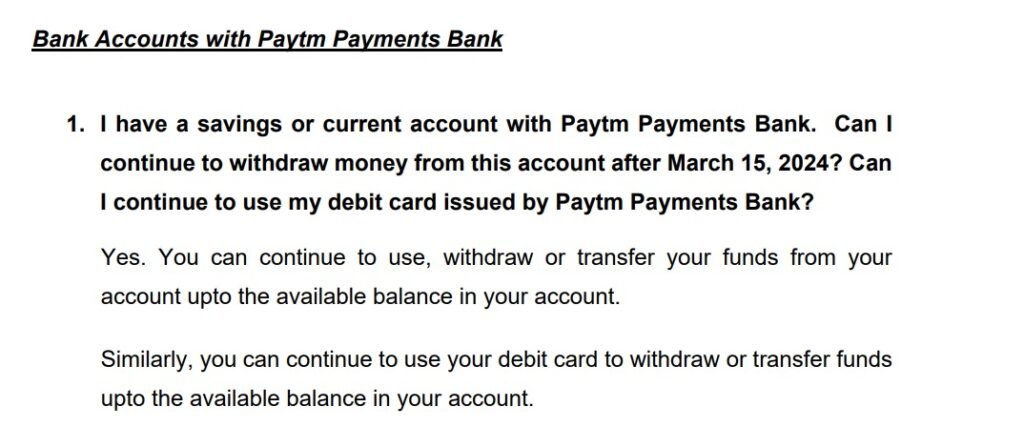

On Withdrawing Money from Paytm Payments Bank After March 15:

Customers can withdraw or transfer funds from their Paytm Payments Bank account up to the available balance. Debit card transactions for withdrawal or transfer are also permissible within the available balance.

On Transferring Funds to Paytm Payments Bank Savings Account:

After March 15, 2024, customers cannot deposit money into their Paytm Payments Bank accounts. Only interest, cashbacks, sweep-ins from partner banks, or refunds can be credited.

Also read – Paytm FASTag: Can Toll Payments Still be Made? RBI Releases FAQs; Get the Details Here

On Refunds and Cashbacks Into Paytm Payments Bank Account:

Customers can receive refunds, cashback, sweep-ins from partner banks, or interest rates after March 15, 2024.

On Deposits with Partner Banks After March 15:

Existing deposits maintained with partner banks through sweep in/out arrangements can be returned to PPB accounts. However, no fresh deposits with partner banks through Paytm Payments Bank will be allowed after March 15.

On Salary, Subsidies, and DBT into Paytm Payments Bank Account:

Customers will not receive their salaries into their Paytm Payments Bank account after March 15. Alternative arrangements are suggested to avoid inconvenience.

On Paying Bills Through Paytm Payments Bank:

Withdrawal and debit mandates for bill payments will be executed if a balance is available in customers’ accounts. However, no credit or deposit will be allowed after March 15. Customers are advised to make alternative arrangements for bill payments.

On EMIs and OTT Bill Payments:

EMIs registered with any bank other than Paytm Payments Bank can continue as usual. However, no credit or deposit will be allowed into PPB accounts for EMI payments or OTT bill payments after March 15.

On Paytm Wallet Usage:

Customers can use, withdraw, or transfer funds from their Paytm wallet to the available balance after March 15. However, no top-ups or transfers into the wallet will be allowed. Refunds and cashbacks can still be credited beyond March 15.

On Closing PPB Wallet and Transferring to Another Bank Account:

Customers can close their wallets with Paytm Payments Bank and transfer the balance to another bank account.

On Onboarding New Customers:

PPB cannot onboard any new customers after March 11, 2022.

In summary, the RBI FAQs provide crucial information for PPB customers regarding handling their accounts and transactions in light of the ongoing crisis. Customers are encouraged to review these FAQs to understand their options and take appropriate action.