While middle-class taxpayers cheer some relief, the real story of Budget 2025 lies in its ambitious capital expenditure plans and its commitment to sustainable development. A deeper dive reveals the challenges that lie ahead.

BY PC Bureau

The Union Budget 2023-24 has, understandably, generated significant buzz around the changes to personal income tax, particularly the increased rebate limit and tweaked tax slabs. These sops, while welcome, represent just one facet of a complex fiscal landscape. Looking beyond these middle-class-centric measures reveals a budget attempting a delicate balancing act, juggling growth aspirations with fiscal realities and broader socio-economic needs.

While the tax relief offers some respite to individuals, its overall impact on boosting consumption and broadening the tax base remains to be seen. Critics argue that the changes primarily benefit those already within the tax net, doing little to incentivize a wider tax compliance. Furthermore, the long-term impact on government revenue needs careful consideration.

Beyond the tax headlines, the budget’s core lies in its substantial 33% increase in capital expenditure. This focus on infrastructure development, from railways and roads to urban infrastructure, signals a commitment to long-term growth. The hope is that this investment will have a cascading effect, creating jobs, stimulating demand, and crowding in private investment. However, the success of this strategy hinges on efficient project execution and timely implementation.

The budget also makes a notable push for “green growth,” with initiatives spanning renewable energy, energy transition, and climate change mitigation. This emphasis on sustainability is crucial, not just for environmental reasons, but also for creating new economic opportunities and positioning India as a leader in the global green economy. The devil, however, will be in the details, particularly in terms of policy implementation and attracting private investment in these sectors.

While the budget acknowledges the importance of agriculture and rural development, some experts feel that the measures announced fall short of addressing the deep-seated challenges faced by the sector. Issues like farmer indebtedness, declining farm incomes, and rural unemployment require more targeted and comprehensive interventions. The success of the budget in achieving inclusive growth will ultimately depend on its ability to address these rural realities.

A key concern that lingers is the management of the fiscal deficit. While the government has projected a gradual decline, maintaining fiscal prudence will be crucial for macroeconomic stability. The budget’s reliance on increased borrowing to fund its expenditure plans raises questions about its long-term sustainability.

Union Minister for Finance and Corporate Affairs Smt Nirmala Sitharaman along with Minister of State for Finance Shri Pankaj Chaudhary and senior officials of the Ministry of Finance called on President Droupadi Murmu at Rashtrapati Bhavan before presenting the Union Budget. The… pic.twitter.com/uFF4ElKUOr

— President of India (@rashtrapatibhvn) February 1, 2025

Furthermore, the budget’s silence on addressing persistent inflation is a notable omission. While the government acknowledges the need to manage inflation, it lacks concrete measures to tackle the rising prices that are impacting household budgets. This is a critical oversight, as uncontrolled inflation can erode purchasing power and undermine consumer confidence.

ALSO READ: Union Budget 2025: What gets expensive, what gets cheaper? Check here

In conclusion, the Budget 2023-24 is more than just its middle-class tax sops. It presents a broader vision for economic growth, driven by capital expenditure and green initiatives. However, its success hinges on effectively addressing challenges related to fiscal management, rural distress, and persistent inflation. The true measure of this budget will be its impact on the lives of all Indians, not just those who benefit directly from tax cuts.

Highlights:

- Increased Capital Expenditure: The budget significantly boosts capital expenditure by 33% to ₹10 lakh crore, the highest ever. This is expected to have a multiplier effect on the economy, creating jobs and stimulating growth.

- Focus on Infrastructure: A major thrust has been given to infrastructure development, with substantial allocations for railways, roads, and urban infrastructure.

- Green Growth: The budget emphasizes green growth initiatives, with proposals for promoting green energy, energy transition, and climate change mitigation.

- Agriculture and Rural Development: Measures have been announced to boost agriculture, including increased agricultural credit, promotion of digital agriculture, and support for rural development.

- Inclusive Development: The budget includes provisions for social welfare schemes, education, and healthcare, aiming to promote inclusive development.

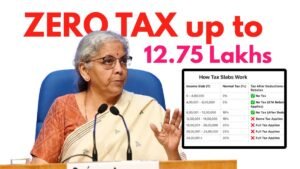

- Tax Relief: The budget offers some tax relief to individuals, particularly in the new tax regime, by increasing the rebate limit and reducing the number of tax slabs.

Pluses:

- Growth-Oriented: The focus on capital expenditure and infrastructure development is likely to boost economic growth and create jobs.

- Green Initiatives: The emphasis on green growth is a welcome step towards sustainable development.

- Support for Agriculture: The measures for agriculture and rural development are expected to benefit farmers and the rural economy.

- Tax Relief: The tax relief measures will provide some relief to individual taxpayers.

Minuses:

- Fiscal Deficit: The fiscal deficit remains a concern, although it is projected to decline gradually.

- Inflation: The budget does not address the issue of inflation effectively, which could impact household budgets.

- Rural Distress: While some measures have been announced for agriculture, more needs to be done to address the challenges faced by the rural sector.

- Middle Class Expectations: The budget has not fully addressed the expectations of the middle class, particularly in terms of tax relief and measures to combat inflation.