Mumbai, February 1, 2026 — Indian equity markets witnessed a sharp and dramatic sell-off on Sunday after Finance Minister Nirmala Sitharaman concluded her Union Budget 2026 presentation, triggering panic selling across sectors and wiping out billions of rupees in investor wealth.

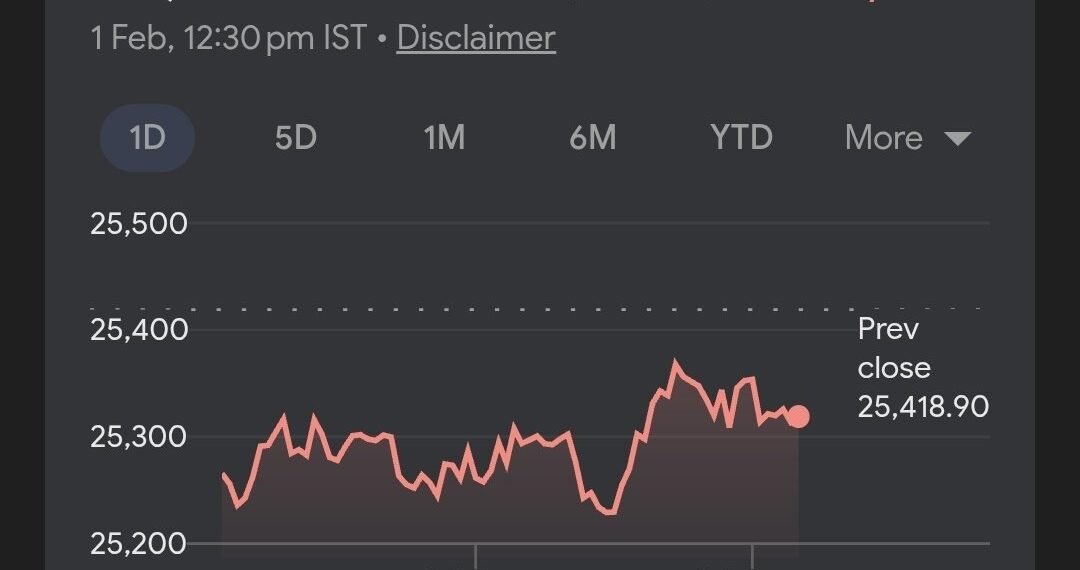

In the special trading session held to coincide with the Budget announcement, the BSE Sensex plunged over 2,000 points, while the Nifty 50 slipped below the 24,700 mark, marking one of the steepest single-session declines in recent months.

The session began on a cautious note, with indices opening flat amid uncertainty ahead of the Budget speech. However, as key announcements emerged, particularly relating to taxation of derivatives trading, sentiment deteriorated sharply, turning the trading floor into a sea of red within minutes.

STT Hike Triggers Panic Selling

Market participants attributed the sell-off largely to the sharp hike in Securities Transaction Tax (STT) on futures and options (F&O) trades, which was raised from 0.02% to 0.05%.

The move, aimed at curbing excessive speculation and stabilising financial markets, caught traders off guard, especially high-frequency and derivatives-heavy investors, who rushed to cut exposure. The sudden spike in transaction costs triggered mass unwinding of leveraged positions, amplifying selling pressure.

“The STT hike fundamentally changes the economics of derivatives trading,” said a senior market strategist. “It directly impacts profitability for traders, market-makers, and arbitrage players, leading to immediate risk reduction.”

🚨 MARKET CRASHED.

Budget shock + STT increase = heavy panic selling.

NIFTY down 900 points.

No relief, higher costs, broken sentiment.

In times like this, capital protection is everything.

DM to join my swing and investment advisor service

#MarketCrash #Nifty50 #Budget2026… pic.twitter.com/YVCYe9yqSh— Short-Term Investing 🇮🇳 (@stocksbyrishabh) February 1, 2026

Heavy Losses Across Key Sectors

The Sensex, which had been trading near 82,000 levels before the Budget, fell to around 80,000, registering an intraday decline of over 1,800 points at its lowest. The Nifty shed more than 700 points from the day’s high.

Sectorally, banking, metals, infrastructure, and consumer stocks bore the brunt of the sell-off. Metal stocks plunged as concerns grew over global demand and domestic cost pressures, while banking stocks weakened amid worries about credit growth and valuation sustainability.

Among the top laggards were Hindalco, Tata Steel, and BSE Ltd, which dropped between 9% and 10%, dragging benchmark indices lower.

Commodities and Currency Add to Gloom

The negative sentiment spilled into the commodities market, with gold and silver futures hitting lower circuit limits, reflecting aggressive profit booking and strengthening of the U.S. dollar.

Meanwhile, the rupee weakened against the dollar, adding further pressure on import-heavy sectors and reinforcing the risk-off mood in financial markets.

READ: Epstein Files Explode: Photos Show Prince Andrew on All Fours Over Woman

READ: Budget 2026: Rare Earth Corridors Planned Across Four States

Capex Boost Fails to Calm Nerves

Although the Budget announced a significant rise in capital expenditure to ₹12.2 lakh crore, aimed at boosting infrastructure and long-term growth, the positive impact remained short-lived. Capital goods stocks briefly gained before succumbing to broader selling pressure.

Market participants said fiscal discipline and infrastructure focus were overshadowed by concerns over market taxation and regulatory tightening, particularly for derivatives traders.

Short-Term Correction Likely

Experts believe the sharp decline could signal a short-term market correction, though the medium-term outlook remains linked to global cues, interest rate movements, and clarity on implementation of the proposed tax measures.

“Markets were positioned for continuity and stability. The STT hike was a surprise, and surprises in taxation almost always lead to knee-jerk reactions,” said a fund manager at a leading asset management firm. “Volatility is likely to persist in the near term.”

Government Defends Measures

The government, however, defended the STT increase, arguing that it would discourage excessive speculation, protect retail investors, and promote long-term investment stability.

Officials maintained that the broader thrust of Budget 2026 — focused on infrastructure, manufacturing, financial market depth, and technology-led growth — would support sustainable economic expansion.

Dalal Street Verdict: Shock and Sell-Off

As the dust settles, the immediate verdict from Dalal Street is unmistakable: the Budget triggered one of the sharpest single-session sell-offs in recent memory, underscoring the sensitivity of markets to tax and regulatory changes.

Whether this proves to be a temporary shock or the start of a deeper correction will depend on how quickly confidence returns — and how effectively policymakers communicate their long-term vision.