Mutual funds fall into the category of market-linked securities and are regarded as a reasonably safe investment. There are hazards, but they can be identified by carrying out the appropriate due diligence.

Although research is crucial, it cannot ensure a profit in the market because of market volatility, which can occasionally be brought on by events outside of our control, such as a pandemic.

If you are aware of your financial objectives, risk tolerance, track record, and the expected future performance of your preferred mutual funds, you can at least avoid making poor investment decisions. For example, negative factors include things like diluted returns, a high expense ratio, and hidden front- and back-end charges.

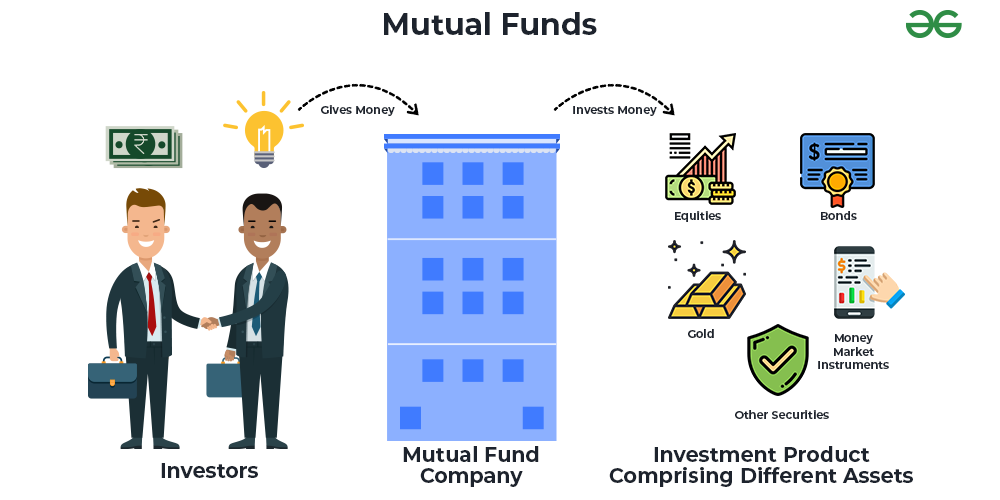

Mutual funds: what are they?

A mutual fund is a type of pooled investment option linked to the market and overseen by a qualified money manager. It provides a wide selection of bonds, stocks, and other securities that align with the investment goals specified in the prospectus of the fund.

Small and individual investors can access professionally managed portfolios through these funds.

It’s also important to remember that, in comparison to buying a single stock or bond, investing in mutual funds can reduce risk. The performance of the fund, less any fees or expenses, determines the returns that investors receive.

What Makes Mutual Fund Investing a Good Idea?

When invested properly, mutual funds can yield healthy returns while minimizing risk—especially when contrasted with individual stocks or bonds.

Because they are managed by seasoned fund managers, these are particularly beneficial for those who are not specialists in the workings of the stock market.

Mutual funds are a well-liked kind of investing where investors pool their money to buy stocks, bonds, and other securities.

The following is a summary of a few advantages that investors who invest in mutual funds experience:

- Typically, they are overseen by seasoned experts, which lowers the possibility of losses for investors.

- Investing in mutual funds lowers the risk of losses from underperforming one area by diversifying across several industries and assets.

- SEBI (Securities and Exchange Board of India) regulates mutual funds, providing an additional layer of security by enforcing mandatory guidelines and safeguarding policies.

Mutual funds are required to maintain transparency by periodically disclosing the assets and performance of their portfolio. - Because mutual funds have minimal administration and investment costs, they are inexpensive.

- Due to mutual funds’ high liquidity, investors can buy and sell units with ease and without experiencing any problems.

When Are You Supposed to Avoid Investing in Mutual Funds?

There are instances in which investing in mutual funds may not be the best course of action for you. This is typically the case with a high management fee. Negative indicators include a high annual expense ratio, high load costs, or high fees associated with buying or selling shares for an investor.

Additionally, mutual funds are not a good choice for those who desire complete control over their investments. This is as a result of fund managers overseeing the assets. It’s also important to keep in mind that some laws and guidelines may reduce the value of returns.

Dilution of Returns: Due to strict regulations, mutual funds are not allowed to have concentrated holdings that make up more than 25% of their portfolio. Diluted returns could result from this. However, most investors prefer mutual funds to diversify their portfolios because it can be difficult to predict which stock will perform well.

Elevated Annual Cost Ratios: Expense ratios, which show investors the annual percentage charge, are disclosed by mutual funds. In 2020, Vanguard revealed an industry-wide average of 0.54%. The amount of fees is 3%. Due to their high fees, investors may find mutual funds unappealing when they can obtain better returns from ETFs or broad-market securities.

Lack of Control: Since mutual funds handle all of the selection and investing, they might not be appropriate for investors who desire total control over their portfolios. Furthermore, a lot of mutual funds might not stick to their declared investing goals, so people who like consistent portfolios shouldn’t use them. Examine the investment philosophy of the mutual fund as well as the index fund it tracks for safety before deciding on one.

High Load Charges: When purchasing or selling shares, investors of mutual funds are subject to front-end or back-end loads, which vary depending on the share class. While many share classes charge 12b-1 fees at the time of sale or purchase, some back-end loads do decrease over time. Load fees can lower returns and turn away regular traders from funds. They range from 2% to 4%.

Also Read: SAIL Recruitment 2024 for Advisor/ Consultant: Check out details here

How Do I Make Mutual Fund Investments?

Today, investing in mutual funds can be done in a few simple steps and is a fairly simple process.

Step 1: Make sure you have access to mutual fund shares and a brokerage account with enough cash on hand. You have two options for opening the account: online or in person at your bank or an investment company.

Step 2: Find mutual funds with minimum investments, fees, returns, and risk profiles that align with your investment objectives. It is important to mention that a lot of platforms provide research tools and fund screening, which can be very beneficial for research.

Step 3: Make your trade and decide how much you want to invest initially. Additionally, automatic recurring investments can be set up. It’s critical to regularly assess the performance of your investments, make any necessary adjustments, and monitor your progress.