The US accounts for 31% of India’s drug exports, with companies like Sun Pharma, Dr. Reddy’s, Lupin, and Aurobindo heavily reliant on the American market.

BY PC Bureau

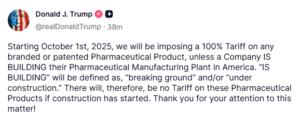

New Delhi, Sept 26 — US President Donald Trump has unveiled one of his most sweeping tariff moves yet, announcing a 100 per cent import tax on pharmaceutical drugs from October 1. The decision, aimed at forcing foreign drugmakers to set up manufacturing bases in the United States, could deal a major blow to India’s pharmaceutical industry, which counts America as its single-biggest market.

Trump made the announcement on his social media platform Truth Social, writing: “I’m putting a 100 per cent import tax on pharmaceutical drugs unless the companies are building plants right here in the United States. Breaking ground, under construction — that’s the deal. No exceptions.”

READ: Wangchuk Pays the Price for Defiance, Loses FCRA Licence of His NGO

The new tariff blitz also includes 50 per cent duties on kitchen cabinets and bathroom vanities, 30 per cent on upholstered furniture, and 25 per cent on heavy trucks. Trump argued that foreign producers were “undercutting US companies” and that tariffs were necessary to protect American jobs and industry.

But while duties on furniture and trucks will ripple through global trade, it is the pharma tariff that has triggered the loudest alarms in India.

Why India Is Vulnerable

India is often called the “Pharmacy of the World.” According to the India Brand Equity Foundation (IBEF), the country supplies 20 per cent of global generic medicines and nearly 60 per cent of vaccines. It also hosts the largest number of US FDA-approved plants outside the United States, making it central to the global pharmaceutical supply chain.

In FY25 (April–December) alone, India exported ₹1.87 lakh crore ($21.7 billion) worth of pharmaceutical products, with the US, UK, South Africa, Netherlands, and France as its top destinations. Globally, pharma exports from India crossed $30 billion in 2024-25.

READ: Ten Kathe Meities Killed in Drone Strike in Myanmar

The United States remains the crown jewel of India’s pharma trade. In 2024, India shipped $3.6 billion worth of medicines to the US, followed by $3.7 billion more in just the first half of 2025, according to data from the Pharmaceutical Export Promotion Council of India (Pharmexcil). In total, the US accounts for 31 per cent of India’s pharma exports, making it the sector’s most critical overseas market.

That reliance now makes India especially vulnerable to Trump’s tariff shock.

What the Tariff Means

The tariff officially targets patented and branded pharmaceutical drugs — a space traditionally dominated by multinational pharma giants. However, Indian industry leaders fear the impact could spill over into complex generics and specialty medicines, categories where India has steadily built influence in the US market.

Generics are the backbone of Indian pharma exports. Companies like Dr. Reddy’s, Sun Pharma, Lupin, and Aurobindo have thrived by supplying cost-effective alternatives to branded drugs. In the US, nine out of every ten prescriptions filled are for generics, yet they account for just 1.2 per cent of the country’s healthcare spending.

If tariffs double the landed price of Indian drugs, that affordability advantage may erode, making it harder for Indian firms to compete. More critically, American patients could face higher drug costs, adding to inflationary pressures and straining government programs like Medicare and Medicaid.

Trump’s pharma tariff has surprised many in the industry because he had previously signaled a phased approach, allowing time for foreign firms to relocate or set up plants in the US. The abrupt “100 per cent from Day One” policy has therefore left companies scrambling.

For India, setting up production in the US is not a simple or quick fix. While several large Indian firms already have limited US manufacturing footprints, the scale of exports means that building enough capacity locally would take years, not months.

Industry experts say smaller and mid-sized Indian exporters could be hit the hardest, as they lack the capital to invest in  US facilities and depend almost entirely on exports to sustain operations.

US facilities and depend almost entirely on exports to sustain operations.

Global Trade and Political Fallout

The US imported nearly $233 billion worth of pharmaceutical and medicinal products in 2024, according to Census Bureau data. With such a massive import dependence, doubling tariffs overnight is expected to send shockwaves through global supply chains.

For India, the timing is particularly tricky. The pharma industry has been one of India’s most resilient export sectors, even during global downturns, and is seen as a flagship of its manufacturing strength. The new tariffs could force India to either:

- Seek exemptions or concessions through trade talks,

- Challenge the tariffs at the WTO, or

- Encourage Indian companies to build or acquire plants in the US, a costly move that may alter the industry’s economics.

Trade analysts also warn that Trump’s move could become a flashpoint in India-US relations, particularly if Indian exports are squeezed while American consumers face rising drug prices.

For now, Indian pharma majors are in wait-and-watch mode, as Washington has not yet clarified the list of specific products to be hit. But the uncertainty alone is already rattling the industry.

As one senior pharma executive told reporters off record: “This is not just about tariffs — it’s about reshaping global pharma supply chains. If India’s access to the US is curtailed, the entire model of affordable generics worldwide could be in jeopardy.”

The bigger question is whether Trump’s gamble — meant to shore up jobs and manufacturing at home — will instead spark higher healthcare costs for Americans and trade tensions abroad.

For India, however, the challenge is immediate and existential: protecting its most lucrative export sector from being priced out of its biggest market