From biscuits to appliances, the latest GST changes promise relief for households and small businesses, with rate cuts across sectors.

BY PC Bureau

New Delhi, September 4 — In a sweeping reform of India’s indirect tax system, the GST Council on Wednesday approved the long-awaited rationalisation of rates, cutting the four-slab structure down to just two. The move, hailed as a “Diwali gift” for households, is expected to ease middle class family budgets, boost consumption, and simplify compliance.

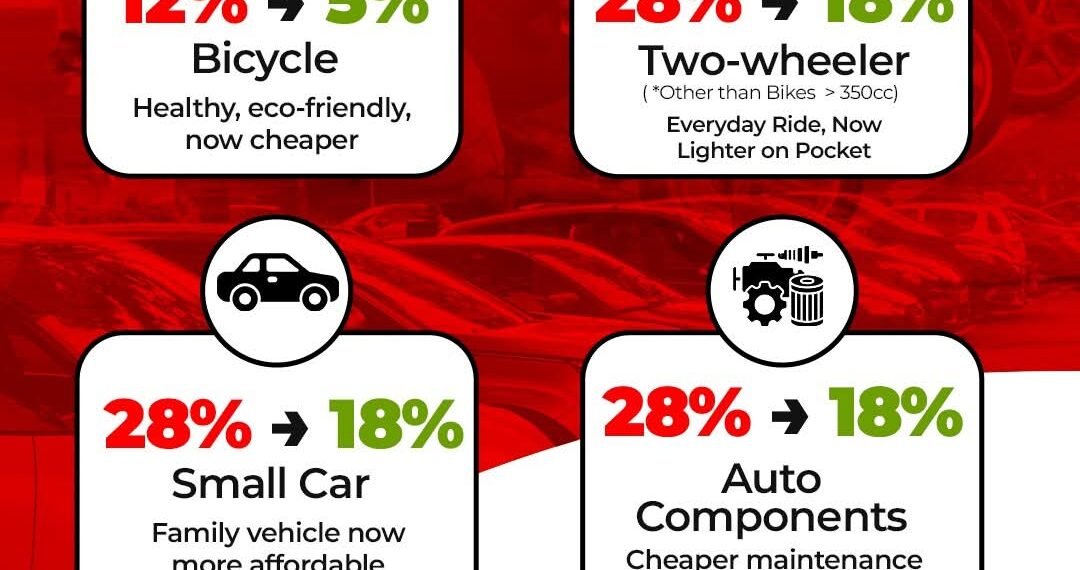

The Council scrapped the 12% and 28% slabs, retaining only the 5% and 18% rates. Most items previously taxed at 12% and 28% will now migrate into these two brackets.

The new rates will come into effect on September 22, 2025, except for tobacco and allied products such as pan masala, gutkha, zarda, bidi and cigarettes, which will continue to attract existing GST and cess until compensation cess borrowings are fully repaid.

“Pan masala, gutkha, cigarettes, chewing tobacco, zarda, unmanufactured tobacco and bidi will remain under current GST plus cess,” the Council clarified in its statement.Major GST Rate Reshuffle Brings Relief to Households, Industry

1/2

The Indian Government gifted the nation an early Diwali surprise today. The GST Council has approved major GST rate cuts effective 22nd Sep.

The 12% and 28% GST slabs have been abolished.

A new 40% slab will apply to sin and luxury goods.

The move simplifies the GST… pic.twitter.com/cfdCvFqwnQ

— Smart Sync Investment Advisory Services (@SmartSyncServ) September 3, 2025

What Gets Cheaper?

The big winners are households and small businesses. A wide set of daily-use goods, food items, medicines, consumer goods, and education products will now fall under the 5% slab, while durables drop from the steep 28% rate to 18%.

Cheaper Items Include:

- Milk products: UHT milk (now exempt), condensed milk, butter, paneer, cheese, ghee (moved to 5% or nil from 12%).

- Staples: Malt, starches, pasta, cornflakes, biscuits, chocolates, cocoa products (cut from 12–18% to 5%).

- Dry fruits & nuts: Almonds, cashews, pistachios, hazelnuts, dates (down from 12% to 5%).

- Sugar & confectionery: Refined sugar, syrups, toffees, candies (shifted to 5%).

- Packaged foods: Vegetable oils, spreads, sausages, fish & meat products, malt-based foods (to 5%).

- Snacks: Namkeens, bhujia, mixtures, chabena (12% → 5%).

- Drinking water: Mineral and aerated water without added sugar (18% → 5%).

- Healthcare: Life-saving medicines, select medical devices (12–18% → 5%/nil).

- Education: Books, pencils, learning aids (nil/5%).

- Consumer durables: TVs, refrigerators, ACs, washing machines (28% → 18%).

- Textiles & footwear: Reduced from 12% to 5%.

- Personal care: Shampoo, hair oil, toothpaste, dental floss (18% → 5%).

- Others: Fertilisers, renewable energy equipment, construction materials, sports goods, toys, leather, handicrafts (all down to 5%).

READ: Manipur Varsity Brings Back Hindi, But Will Cinema Halls Dare Follow?”

What Stays Expensive

Certain goods will continue under high GST and cess, or face higher taxation under the new system:

- Sin goods: Pan masala, gutkha, chewing tobacco, zarda, bidis and cigarettes (high GST + cess; valuation now on retail sale price).

- Sugary drinks: Aerated and flavoured beverages (28% → 40%).

- Luxury goods: Cigarettes, premium liquor, high-end and armoured cars (40%).

- Coal: Hiked from 5% to 18%, raising input costs for power and industry.

- Restaurants in specified premises: Will no longer have the option of 18% with input tax credit.

- Lotteries & intermediaries: Revised valuation rules, keeping effective tax burden high.

Industry Reaction: Demand Revival Expected

Consumer goods makers and market watchers welcomed the reform. FMCG leaders said lower GST on food items would directly boost demand.

In a move welcomed by households, health insurance has been exempted from GST (earlier taxed at 18%). This is expected to improve penetration in a market where less than 20% of Indians have private health coverage. Some states, however, flagged concerns over potential revenue losses.

Revenue Outlook

While opposition-led states warned of a possible revenue shortfall of ₹1.5–2 lakh crore, SBI Research projected that overall GST and devolution receipts would keep states net positive. GST collections for FY26 are estimated at ₹14.1 lakh crore, including ₹10 lakh crore in SGST and ₹4.1 lakh crore from central devolution.

The effective weighted average GST rate, which has already fallen from 14.4% in 2017 to 11.6% in 2019, may now dip further to 9.5%. Past rationalisations showed a short-term dip in revenues, followed by a strong rebound, often adding close to ₹1 trillion to collections.

Introduced on July 1, 2017, GST began with four slabs — 5%, 12%, 18%, and 28% — plus cess on luxury/demerit goods. The cess pool ended in 2022, leaving states dependent on tax buoyancy.

The latest reform, reducing GST to just two main slabs of 5% and 18% (plus 40% for sin goods), is being hailed as “GST 2.0” — a simpler, fairer system expected to strengthen consumption and bring the original promise of GST closer to reality.