Despite the firm linked to Parth Pawar being at the centre of the scandal, the IGR panel says only those directly involved in executing the sale can be indicted, reinforcing the accusations already mentioned in the police FIR.

BY PC Bureau

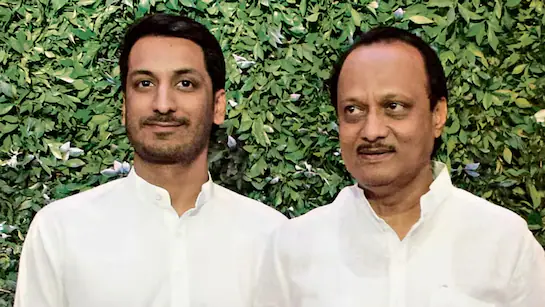

November 19, 2024: A committee headed by a Joint Inspector General of Registration (IGR) has submitted its findings on the controversial ₹300-crore Pune land deal involving a firm partly owned by Parth Pawar, son of Maharashtra Deputy Chief Minister Ajit Pawar. The committee has held three individuals responsible for the irregularities flagged in the police FIR, a senior official said, but it has not found grounds to indict Parth Pawar himself.

According to the official, the three-member panel’s report—submitted on Tuesday—does not mention Parth because his name does not appear on any of the documented transactions examined during the inquiry. The official stressed that the committee was required to act strictly on the basis of recorded evidence, and there was no documentation linking Parth directly to the disputed sale deed.

The panel, chaired by Joint IGR Rajendra Muthe, presented its findings to Inspector General of Registration Ravindra Binwade, who then passed the report on to Pune Divisional Commissioner Chandrakant Pulkundwar for further action.

The deal at the centre of the controversy involves 40 acres of prime land in Pune’s upscale Mundhwa locality. The land was sold to Amadea Enterprises LLP, a company in which Parth Pawar is a partner. The transaction came under scrutiny after it emerged that the land is government-owned and therefore cannot be sold. Moreover, the company was granted an exemption from paying a hefty ₹21 crore in stamp duty, raising further questions about the transparency of the process.

“Since Parth Pawar’s name does not appear anywhere on the sale deed, he cannot be indicted as part of this probe. The report indicts only those who were directly involved in executing the deal, including the suspended sub-registrar Ravindra Taru,” the official explained.

READ: SC to Hear Plea on Hmar Youths Killing in Jiribam

READ: A Third of Ambani’s Wealth Needed for Nitish’s Poll Promise

Along with Taru, the report names Digvijay Patil—Parth Pawar’s cousin and business partner—and Sheetal Tejwani, who held power of attorney on behalf of the purported land sellers. All three are already listed as accused in the FIR registered by the Pune police, and the committee’s findings reinforce those allegations.

Two other inquiry bodies—one from the revenue department and another from the settlement commissioner’s office—are also conducting parallel investigations. Their reports will be consolidated and forwarded to Additional Chief Secretary (Revenue) Vikas Kharge. Kharge heads a six-member panel appointed by Chief Minister Devendra Fadnavis to examine every aspect of the contentious deal, which has since been cancelled amid mounting criticism.

The Muthe committee has not limited itself to assigning responsibility; it has also suggested several measures to prevent similar fraudulent transactions in the future. One major recommendation is that any plea for a stamp duty waiver must undergo thorough scrutiny and receive explicit approval from the collector (stamp). This, the committee argues, would improve accountability and reduce the scope for undue favours.

Citing Section 18-K of the Registration Act, 1908, the report emphasises that land transactions can be registered only when a valid 7/12 extract—no older than one month—is furnished alongside all documents proving rightful ownership. This requirement, the committee notes, is essential to ensuring that ownership is verified before any sale is allowed to proceed.

The report also points out that an important amendment introduced on April 20, 2025, now prohibits sub-registrars from executing transactions involving government-owned land. However, the committee says the rule currently applies only when government ownership has been clearly established. It recommends extending this safeguard to cases where government ownership, possession, or interest remains uncertain or disputed, arguing that this would close a significant loophole.

Meanwhile, the IGR office has issued a notice to Amadea Enterprises demanding payment of ₹42 crore in stamp duty, which becomes payable due to the cancellation of the deal. The company initially requested 15 days to respond, but officials granted only seven days.

“We have given the firm one week to submit its reply to the notice,” an official from the IGR office said.