Amid a fresh wave of GST Payment notices being sent to traders over digital payment mismatches, industry bodies and tax professionals are advising traders to proactively seek clarification from the tax department to avoid unnecessary penalties and disputes.

Many traders across sectors have reportedly received GST notices where the department has flagged differences between their GST returns and digital payment data obtained from payment gateways and banks. In several cases, the notices demand explanations for these discrepancies, creating confusion among small and medium businesses unfamiliar with reconciling digital payment data with their GST filings.

ALSO READ: Byron’s Wife Megan Kerrigan Makes Bold Moves After Coldplay Scandal

Unregistered Small Biz and UPI Trade Under GST Scrutiny

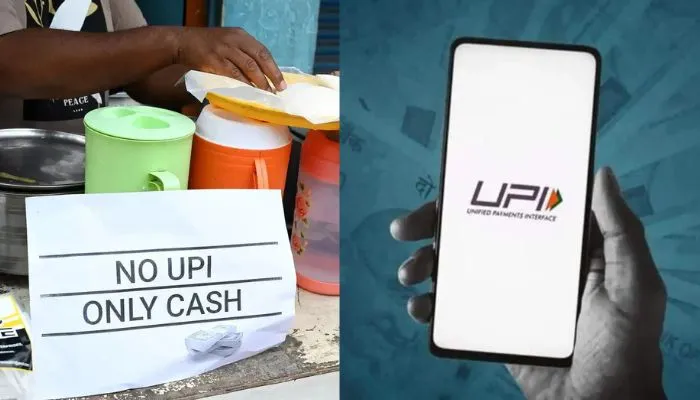

Small businesses operating without GST registration while accepting payments through UPI and other digital modes are coming under increased scrutiny from tax authorities, as the government intensifies efforts to widen the tax base and curb revenue leakages.

ALSO READ: Outdated Laws Costing Delhi Business: LG, CM Push for Revamp

Notices have begun reaching some small traders, seeking explanations for high-value UPI and digital transactions without corresponding GST compliance.

Many small and micro businesses, especially in retail and services, have adopted UPI and QR-based payments for ease of transactions. However, in some cases, they have not registered under GST, either due to lack of awareness about threshold limits or under the assumption that digital payments do not trigger GST liabilities. Tax experts clarify that once a business crosses the prescribed turnover limit, GST registration is mandatory, irrespective of payment mode.

Why GST Notices Targeting Small Traders Frequently

There are several reasons behind issuing GST Payment notices to Small Traders:

- Digital Payment Mismatches: There have been discrepancies between GST returns and payment data from UPI, payment gateways, or bank accounts. Furthermore, Sales shown in returns may not match digital receipts flagged by the department.

- Crossing Turnover Limit Without Registration: Various Traders are exceeding the ₹20 lakh/₹40 lakh turnover threshold but operating without GST registration. Using UPI or QR codes makes transactions traceable, triggering notices.

- Non-Filing or Delayed Filing of Returns: Registered traders have been failing to file GSTR-3B, GSTR-1, or annual returns on time and are filing returns with NIL data while having actual transactions.

Impact of GST Payment Notices on Small Traders

- Increased Compliance Burden

– Small traders must spend time and resources gathering documents, reconciling digital payments, and responding to notices.

– Many need to hire accountants, increasing operational costs. - Cash Flow Disruptions

– Small demands for tax payments, interest, or penalties can affect working capital.

– Funds may get blocked during the resolution of disputes. - Business Disruptions

– If notices are not responded to, GST registration may get suspended, impacting day-to-day operations.

– Supply chain disruptions if vendors demand GST compliance. - Possibility of Penalties and Interest: If discrepancies are not justified, traders may face additional tax demands, penalties, and interest charges.